What Thai Law Applies to Withholding Tax (WHT) Upon the Sale of a Condominium?

The Thai law that applies to retention tax upon the sale of a condominium is the Revenue Code of Thailand. Section 48 and 50 of the Revenue Code outline the rules around withholding tax and immovable property, stating that they’re subject to progressive tax brackets outlined in a separate Royal Decree.

According to Thai tax and property law, the amount taxed is based on the sale price or appraisal value of the property (whichever is higher) in the case of corporations. For them, the taxable amount is 1% of this final value.

For individual sellers, withholding tax upon the sale of property is a function of net income including the Land Department’s official valuation of the property sold. The length of time that the property has been owned affects the amount of payable tax, with short-term property owners allowed to take advantage of higher deduction limits. Withholding tax can be divided into a maximum of 8 years.

How To Calculate Individual Property Tax Gain in Thailand

To calculate property tax gain for private property sellers in Thailand, both Thai nationals and foreigners must understand that you need the official Land Department appraisal price of the property as it is treated as gross income for tax calculation methods. You can then deduct Index B expenses based on years of ownership to get net income.

After determining the net income from the property sale also called ‘income tax’, you then divide the income by the number of years of possession, with 8 years being the upper limit based on the Revenue Code. Take this total and determine your yearly Index A tax bracket.

The final step is to take the yearly tax burden and multiply it by the number of years the property was in possession. This is the total of withholding tax due.

Step 1 – Estimate the Appraisal Value of the Property

Estimating the appraisal value of the property is the first step in calculating your withholding tax due from real estate transfers.

The Thai government lists appraisal values of property on a government database which is updated every 4 years. You can evaluate your property appraisal on that website and use the official estimated price (not the actual sale price) in calculating property gain tax due.

Step 2 – Count the Number of Years You Held the Property

Counting the number of years you held the property in question will help you determine the total deductibles allowed on your gross income from the sale of that real estate.

The first year of ownership for the purpose of tax deduction is the date of purchase to the end of the fiscal year. The last year of ownership begins on the first day of the fiscal year and ends on the date of sale.

For example, a property purchased on August 17th, 2017 and sold on January 9th, 2019 would count as 3 years for the purpose of calculating deductibles.

Step 3 – Evaluate the Yearly Assessable Net Income

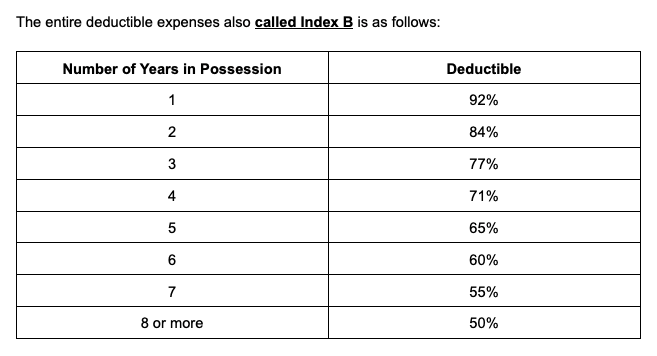

You can evaluate the yearly assessable net income by taking the total years of ownership and comparing it to the Index B deductible table. The tax-deductible expenses range from 92 to 50% of gross income from the sale of real estate from 1 year of ownership to 8 years and over.

For example, if someone owned property with a value of 5 million baht for 3 years, their deductible would be 77%, leaving them responsible for 23% of the property’s sale or appraisal value. In this case, you can calculate the total taxable amount by multiplying the total value by the taxable percentage as follows:

5,000,000 x 23% = 1,150,000 baht

Step 4 – Determine the Annual Personal Income Tax Due

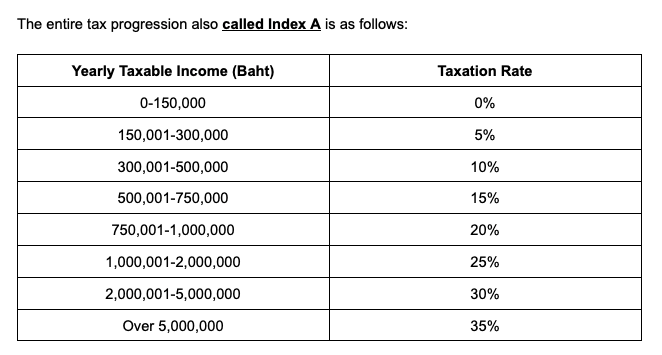

Determining the annual personal income tax due can be done by taking the overall taxable amount and dividing by the number of years of possession. Once you have the yearly taxable income, you can compare it to the Index A table to get your overall tax rate.

The tax rate is the same as Thailand’s progressive personal income tax levels. For example, if you sold a property for 5 million baht that you owned for 3 years, your per-year taxable income would be 383,333 baht. This puts portions of your property sale income in the 0, 5, and 10% brackets.

The total calculation would be (150,000 x 0%) + (150,000 x 5%) + (83,333 x 10%) for a total of 15,833 baht per year.

Step 5 – Multiply the WHT by the Number of Years of Possession

Multiplying the WHT by the number of years of possession is the final step in determining how much you owe in tax after the sale of your property. To get the final sum of tax owed, you take your taxable yearly income and multiply it by the original number of years of possession.

For example, if you’ve determined that your yearly tax owed on a 5 million baht property owned for 3 years is 15,833 baht, you simply multiply that number by 3 years to get 47,499 baht.

The final amount must be paid by the seller at the Land Department. Depending on the seller, the amount due can become either a final tax payment or count against the personal income tax liability of the seller.

Can I File a Claim for a Withholding Tax Refund Upon Selling my Property in Thailand?

Yes, you may have the ability to get the refund for your WHT upon selling your property by treating your payable taxes as an ‘advance tax’. As a taxpayer independent from a business, you will have to calculate a tax payable on the sale of your condominium using the following formula assuming that you do not derive other income subject to Thai personal income tax and file a year-end tax return:

Tax payable = (value of the condominium unit sold as appraised by the Land Department – cost – other allowances) x tax rates

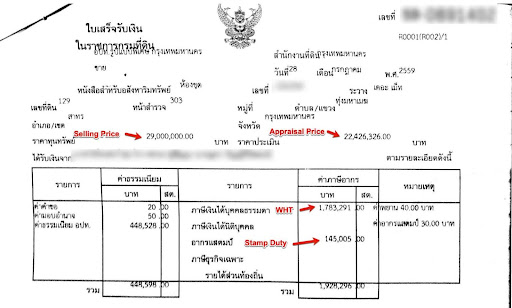

Here is a real case study of our client selling his condo (see attached blue receipt):

- Foreigner that is not living or earning income from work in Thailand

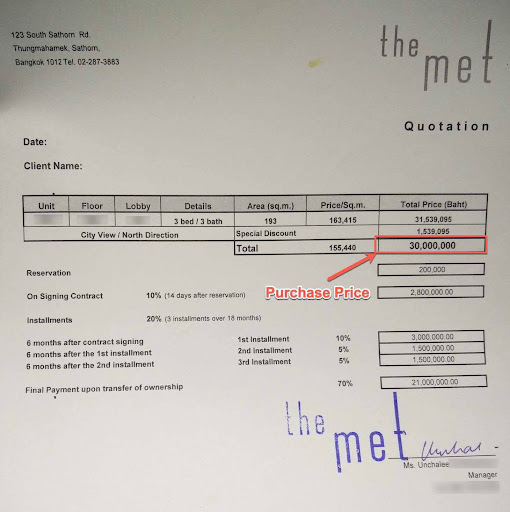

- The property cost him 30 million baht, purchased in 2009

- The condo was sold at 29 million baht in 2016

- The appraisal value of his condominium unit can be found in the blue receipt issued by the Land Registry Office is 22,426,326 baht.

- Total taxes upon selling is 1,928,296 baht which includes a stamp duty of 145,005 baht and the WHT (income tax) of 1,783,291 baht.

Here we are going to break down the Withholding Tax amount (222,911 baht X 8):

Take the appraisal price from the Land Department of 22,426,326 baht and multiply by a 50% deductible (8 years of ownership) to get a total of 11,213,163 baht. Divide this by 8 years to get 1,401,645 baht.

The total taxable amount per year is (300,000 x 5%) + (200,000 x 10%) + (250,000 x 15%) + (250,000 x 20%) + (401,645 x 25%) for a total of 222,911.25 baht. Multiply this by 8 years for a final WHT of 1,783,291.

Note that there is no tax exemption for the first 150,000 baht on property sales, so all income earned on such a sale from 0-300,000 baht is taxed at the 5% rate.

On the basis that the client does not derive other income subject to Thai tax in the year 2016, he should be able to get the whole amount of 1,783,291 baht back (excluding the stamp duty of 145,005 baht), provided that he can submit a document proving that he actually paid the price of 30 million baht for his condominium unit.

In general, to reduce your WHT burden, you must have access to documents that verify the cost of your condominium unit. Documents that can prove your condo’s purchase price include the sale and purchase agreement and the receipt for purchasing the property.

The refund process should take approximately 3 months. In the case where you file the tax return by the due date (March 2017) and you still have not received the refund by June 2017, you are entitled to the interest.

If the tax payable according to the formula is less than 1,928,296 baht, this client could get a refund of the difference. If the tax payable exceeds 1,928,296 baht, it would be preferable to treat the tax of 1,928,296 baht as ‘final’ which means they would not have to pay any additional tax.

To reduce withholding tax upon selling property in Thailand, you first need to calculate the total withholding tax due from the real estate sale and compare it to your other income. Treating withholding tax as a ‘final tax,’ one that doesn’t require reporting on the year-end tax return, may be beneficial depending on how much other Thai income you have and what types they are.

On the other hand, you can also reduce your tax burden in some cases by treating withholding tax as an advanced tax. In that case, you’re still paying the tax after the sale, but you have to file a year-end tax return, at which point you may get a refund.

Note that to file the tax return you must have a tax ID (if you have not obtained one).

Tax advisors can help you to weigh the pros and cons of either approach and can sometimes save you as much as 45% of the tax payment as happened with our client in the above case study.

How to Apply for a Taxi ID for Foreigners in Thailand?

The main condition for reducing your withholding tax in Thailand is that you have a tax identification number. If you have a Thai tax ID, you can file a tax return and apply for a refund depending on your circumstances.

To apply for a tax ID number, provide the following personal information to the Revenue Department or a local tax office in person:

- Your name and surname

- Your home country address

- Your address in Thailand, specifying whether it’s a residential or employer location

- Your date of birth

- Your nationality

- Your passport number

- The authority that your passport was issued by

- The name and surname of your spouse (if any)

What Is the WHT on Property Sales for Corporate Owners?

The WHT on property sales for corporate owners is 1% of the registered sale value of the property or the appraised value (whichever is higher). This tax is deducted immediately following the transfer of the real estate in question.

Those subject to the corporate withholding tax rate include companies and juristic persons (those partnerships registered with the commercial registrar) according to Section 69 ter of the Revenue Code.

Thailand’s Revenue Code also states that the person responsible for withholding tax at the point of sale is the buyer of the property, which may be an individual, partnership, company, association, or groups of people.

Transferring your condo and getting confused by withholding tax payments? For more information on property sales and getting the most out of your investment, chat with one of PropertySights Real Estate’s seasoned experts today.