Applying for a home loan to support your property purchase in Thailand? Learn more about borrowing criteria, down payments, installment durations, interest rates, as well as the required supporting documents for a successful home loan in this article by PropertySights Real Estate.

What Are The Bank Of Thailand’s Housing Loan Regulations?

The Bank of Thailand’s housing loan regulations that came into effect on April 1st of 2019 put stricter limits on the Loan to Value ratio (LTV) for second and third homes as well as those valued over 10 million baht.

Put simply, while commercial banks in Thailand offer different rates based on many personal factors, the highest possible mortgage as a percentage of those applicable property values became smaller. As a result, some required down payments grew larger.

The Bank of Thailand’s housing loan regulations on properties under 10 million baht in value can be broken up into the following key points:

- The first house’s LTV can be 90-95%, meaning a 5-10% down payment.

- If the owner has been paying that first house loan for at least 3 years, a second house’s LTV can be as high as 90%. If the first loan has been paid for less than three years, the second house’s maximum LTV is 80%. The down payment will be 10-20% based on the length of the first loan payment.

- The maximum LTV from the third house and onward is 70%, meaning a down payment of 30%.

The following rules apply to properties valued at more than 10 million baht:

- The maximum LTV on the first two houses is 80% and the down payments are 20%.

- The maximum LTV from the third house and onward is 70%, meaning a down payment of 30%.

Why Are Property Mortgage Regulations Important?

Property mortgage regulations are important because they help to maintain the health of the property sector and the overall economic system. If LTV ratios are higher and down payment requirements are lower, it can lead to over-speculation within the market. This, in turn, can make it harder for average people to buy property.

2020 research published in The Review of Financial Studies also found that housing speculation can make economic downturns worse. This was part of the reason for the 2008 global financial crisis.

In the past, people could buy a property in Thailand through a housing loan with no down payments. The Bank of Thailand’s mission is to keep the economy healthy and the real estate market fair with higher barriers to entry.

Home Loan Real Estate Collateral Types

The 4 real estate types that can be used as collateral for a home loan in Thailand are house, townhouse, commercial, and condominium. Different regulations and individual bank policies may apply depending on the type of property.

For example, commercial loans require more extensive documentation in the form of things like corporate registration certificates, financial statements, employment contracts, shareholder registration, and more. Maximum installment periods can be as short as 7 years while total loan values tend to be much higher than residential properties.

Each bank will have its own policy toward residential categories like houses, townhouses, and condominiums, with different rates applying to each one.

Yet another category of loan with a maximum LTV rate of 90% is for house building loans. That percentage is based on the appraised value of the land and future building. A similar category of loan for constructions or repairs on existing homes is also available.

How To Prepare For A Mortgage Application

When applying for a mortgage, the most important thing you can do to prepare is to secure your overall financial situation. This includes clearing all debts, ensuring that your credit history is clean, and maintaining regular bank account inflows for at least 6 months leading up to the application.

Aside from creating a stable financial picture for the Thai lenders, you’ll need to gather several other documents that verify your identity and circumstances in the Land of Smiles.

Finally, you should have a clear picture of your goals before setting an appointment. How much can you afford to pay upfront? What duration are you hoping for on the mortgage? Will you take a loan out to pay for furnishings and household goods?

Many applicants fail to receive a home loan. Answering those questions and making the following preparations will dramatically increase your probability of getting a mortgage and provide greater peace of mind.

1. Decide How Much You Want To Borrow

Deciding how much you want to borrow, and therefore how large your down payment will be, is the most important piece of information to decide before setting up a home loan. This can impact the interest rates you’re offered, the loan duration you can handle, and ultimately the amount of money you’ll save over time.

How Large Can A Home Loan Actually Be?

How large a home loan can actually be depends on the applicant’s salary, current debt, and the bank’s policies. Commercial banks will generally use 40% of a person’s monthly salary as a baseline and subtract the monthly cost of any recurring debt for things like cars or other loans.

Taking a salaried employee making 40,000 baht per month as an example, the maximum monthly payments they could make would be calculated as follows:

40,000 x 40% = 16,000 per month. If the employee has a monthly debt of 6,000 baht, it would be subtracted from this for a potential monthly installment of 10,000 baht.

Total loan amounts are calculated based on a ratio involving a 7,000 baht monthly installment to a loan total of 1,000,000 baht. An employee’s total home loan value would be calculated as follows, assuming they have no debt:

(1,000,000 x 16,000) / 7,000 = 2,285,714 baht total.

This is the maximum mortgage that they would offer to the applicant. However, Bank of Thailand regulations apply, so if this number exceeds the possible 90% LTV ratio for a first house, they would have to lower the total to meet with those rules.

2. Agree On The Interest Rate

Agreeing on a loan’s interest rate is one of the factors that determines how much extra money your real estate will cost you. Different banks may offer slightly different rates, and these rates may be structured differently over the life of the loan. For that reason, assessing different rates and finding the best one for you is crucial.

Prime debtor lending rates set the Minimum Loan Rate (MLR) which is used as a basis for floating interest rates. This fluctuates over the years, so averaging the interest over the life of the loan is a useful way to compare rates.

3. Settle On A Loan Duration

Settling on a loan duration can be difficult as it means choosing between easier payments but more interest overall or a strict budget in the near term with less paid to the bank in the end.

Your age will factor into how long your loan duration can be, too. In Thailand, the typical length offered is from 15 to 30 years. However, mortgages cannot be so long that they’re still active after the borrower has turned 70.

4. Prepare To Pay Monthly Installments On Your Home Loan

Preparing to pay monthly installments on your home loan is often overlooked when entering a mortgage contract. Having the down payment ready is step one, but leaving a cushion for yourself to make early payments and to have a safety net for emergencies will put you even more at ease.

On top of having a healthy sum of cash ready, evaluating your circumstances to ensure you’re ready to continue with payments throughout the life of the loan is just as crucial.

What Mortgage Payment Strategies Are Available In Thailand?

The 4 main mortgage payment strategies available in Thailand are:

- Floating rate mortgages. Each bank offers mortgage interest rates based on the Minimum Retail Rate (MRR) supplied by the Bank of Thailand. Floating rate mortgages follow this rate, usually on a 6-month or yearly basis. Such mortgages may be more attractive in times of inflation when rates are already high.

- Fixed rate mortgages. Banks may offer a fixed rate over the duration of a loan based on current rates and future rate projections. This type of loan can be beneficial when interest rates are low, though it may end up more costly if rates drop further.

- Balloon mortgages. A type of mortgage sometimes offered by banks where monthly payments are smaller during the life of the loan but end with a final, large installment. The advantage of these loans is that the final installment may not be counted toward your average monthly payments, making a larger overall loan possible.

- Bridge mortgage. This is a short-term loan that may have a duration of as little as a few months or as long as two or three years. This mortgage may use your current home as collateral and is a useful option when trying to buy a new property before you’ve sold an existing one.

What Are The Documents Required For A Home Loan Application?

The three main document categories required for a home loan application are as follows:

- Personal identification to provide a clear picture of who you are and your marital status.

- Financial records to show that you’re financially responsible.

- Details of the property that will be used as collateral for the loan.

Every person is different and every bank is different, so some applications may require more documentation than others.

Full Identification Of The Home Loan Applicant

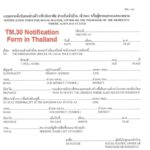

Originals and copies of the following documents are necessary to provide full identification of the home loan applicant:

- Government issued ID card. Non-residents may need to use their passports.

- All pages of the house registration book, or Tabien Baan, that you’re registered to.

- Spousal documents such as marriage certificate, divorce registration, death of spouse certificate, and/or separation notice, if applicable.

Documents Proving Fiscal Responsibility

The following documents are typically necessary to prove the applicant is fiscally responsible:

- Salary certificate.

- The past 3 months of salary statements from your workplace.

- Income tax statement or withholding tax certificate (50 bis) if on a cash salary.

- Original bank account book showing past 6 months of activity and copies.

- Professional license if you’re self-employed.

If you run a business, you’ll need to provide several additional documents including:

- Current account statements of the business for the past 6 months.

- The business’s account statements over the past 12 months.

- Business or trade registration certificate (Memorandum of Association).

- Additional evidence as requested such as financial statements, evidence of tax payment, and photographs of any physical real estate.

What Happens If There Is A Co-Signer On The Home Loan?

If there is a co-signer on the home loan, they must provide their own personal identification documents and financial records. The lender will then take these into consideration alongside the other borrower’s information and the details of the property.

Details Of The Property To Be Used As Collateral

The following details of the property to be used as collateral must be provided to give lenders a better idea of what is guaranteeing the home loan:

- Photos taken outside and inside the property.

- Map showing the location.

- Copy of the land title deed when purchasing land or properties fixed to land.

- Copy of the condominium ownership document in the case of individual condo unit ownership.

- Copy of Purchase and Sale agreement and evidence of down payment.

- Copies of other documents associated with the land or building such as land purchase contract, house building permit, or a document showing ownership of the building.

- If purchasing property second-hand from a private seller as opposed to a development project, you’ll also need to prepare a copy of their ID and house registration book.

What Expenses Should You Be Aware Of When Taking Out A Home Loan?

Anyone taking out a home loan must be aware of extra expenses such as bank fees, insurance, land department costs, and the actual sale of the property.

Aside from interest on the loan, banks may charge upfront costs such as inspection fees, appraisal fees, and traveling fees while doing research on the property. Some banks also require refundable commitment fees and prepayment fees that are applied if you overpay in the first few years, each of which are typically around 2% of the loan.

Banks may require various types of insurance including insurance on the mortgage itself and fire insurance, too. They’ll also collect a stamp duty of 0.05% of the loan’s value and pay that to the Revenue Department.

Another large source of early expenses comes from the Land Department where you’ll have to pay a mortgage fee of 1% on the home loan’s value. On top of the mortgage fee, there’s also a land transfer fee of 2% on the appraised or sales value (whichever is higher). This may be paid by the seller, the buyer, or a combination of the two.

Finally, you’ll need to prepare for expenses relating to the real estate itself. This includes the down payment and other smaller fees such as water and electric utility insurance which will depend on the size of the property but is often around 10,000 baht combined.

Potential Reasons For Banks To Reject A Home Loan Application

Banks typically reject a home loan application for reasons related to your personal, financial, and collateral property document disclosures. One simple reason could be that an applicant didn’t submit all of the necessary documents.

However, the most common reason for mortgage application rejections is because of a poor financial history. This could be caused by one or more of several factors:

- A large amount of debt, either recurring or in your past 6-month bank account book statement.

- Poor credit score which takes your past 3 years of credit history into account. You can check your credit history before making an application with Thailand’s National Credit Bureau.

- Low or unstable salary. Unstable may be up to the discretion of the bank as they have their own hierarchy of reliable occupations.

Finally, loans may be turned down because of the property itself. If the bank’s inspections find that the real estate isn’t suitable for collateral, it may refuse to lend the money.

Are Foreigners Allowed to Finance a Condo Loan in Thailand?

Yes, foreigners are allowed to finance a condo loan in Thailand, or a mortgage as outlined in the Civil and Commercial Code Section 702. Foreigners can access these loans through several financiers in Thailand. However, options are limited compared to Thai nationals.

The Most Popular Thai Banks for Foreigners Applying for a Mortgage (Home Loan)

The Most Popular Thai Banks for Foreigners Applying for a Mortgage (Home Loan) are Industrial and Commercial Bank of China (ICBC), MBK Guarantee, and UOB. The conditions around their mortgages are as follows:

| ICBC | UOB | MBK Guarantee | |

| Property Types | Freehold condominiums | Freehold condominiums | Freehold condominiums |

| Loan Period (years) | 3-15 | 3-30 | 1-10 |

| Loan Amount | Up to 70% of purchase price, minimum 1.5 mil. THB | Up to 70% of purchase price, minimum 2 mil. THB | Up to 50% of purchase price, minimum 1 mil. THB |

| Age (years) | 21-55 | 21-65 | Max 70 at end of term |

| Interest | 1st year: 5.25%, 2nd year: 5.75%, 3rd year onward: 1 year SIBOR + 6%** | 6-8% | MLR + 3.4% |

| Special Conditions | Mainland China citizens must have a work permit. Unnecessary for other foreigners. | Prioritizes Singapore and Malaysian buyers. | No requirement for work permit or PR. |

**Based on early 2023 numbers. The Singapore Interbank Offered Rate (SIBOR) was the benchmark rate offered between Asian banks in Singapore dollars. It has since been replaced with SORA (Singapore Overnight Rate Average).

What Are the Conditions for Aliens Securing Real Estate Home Loans in Thailand?

When securing a real estate home loan in Thailand, aliens must meet the following conditions:

- Have legal connections to Thailand, either through a lengthy (more than a year) work permit history, permanent residence, marriage to a Thai national, or Thai citizenship.

- Be from 21 to 55 years of age.

- Have good credit and a stable income.

- Be ready to agree to a maximum payback period of 15 years.

- Have 30-40% of the property’s value available for a down payment.

- Be ready to pay interest rates that are higher than what a Thai national would get.

Can My Thai Spouse Secure a Mortgage With a Local Bank?

Yes, your Thai spouse can secure a mortgage with a local bank as long as you both are working, have stable incomes, and have good credit scores. The downside to this method is that you would be acting as a guarantor to the loan which means that your Thai spouse would be the real owner of the property.

FAQ About Home Loans in Thailand

Can You Get A Refund From The Seller In The Event Of A Failed Home Loan Application?

Yes, in the event of a failed home loan application you can get a refund from the seller on deposits as long as the terms and conditions in the sale and purchase agreement don’t specify the deposit is non-refundable.

Failure to be granted a loan is not grounds for placing the applicant at fault and therefore voids the spirit of the contract according to section 377 of the Civil and Commercial Code of Thailand. Section 372 further explains that voiding a contract because of a creditor does not entitle the seller to retain the deposit. Section 55 details the rights of the prospective buyer to demand the money via a lawsuit.

What Are the Stages in a Mortgage Application in Thailand?

The 6 main stages in a mortgage application in Thailand are:

- Getting pre-approved for a mortgage. Analyze your finances, including information such as debt burden, monthly income, and total savings available for a down payment. Go to a bank for pre-approval and get a better idea of what interest rate and loan duration to expect. That pre-approval can then be used to more accurately gauge what you can afford and show sellers that you’re serious.

- Making an offer on a property. With the help of a PropertySights Real Estate licensed consultant, you can get a better idea of what’s available within your price range and negotiate the best deal possible. At this stage you’ll likely need to make a deposit on the property.

- Formally applying for the mortgage. Gather the necessary identification, financial, and property documents and bring them to the bank. Organize your information carefully because loans are often turned down for a lack of documentation. If you want to shop around for the best rates, you can take your information to multiple lenders at this stage.

- Finalizing the loan. Mortgage lenders will take your documentation and provide a loan estimate detailing the loan amount, interest rate, monthly payments, and more. You’ll have about two weeks to compare the estimates provided by your potential lenders. After choosing the one that you like the most, the lender will send the loan to the consumer loan center for underwriting which is a more detailed assessment of the lender’s risk, including a property appraisal. This step will determine and lock in your interest rate.

- Sign the loan and mortgage contract. Once you’ve agreed to the terms in the loan, you’ll make an appointment with the lender to sign a formal document at the Land Department. If there’s a co-borrower, they should attend this meeting, too.

- Closing on the property. Attend a meeting with the seller and your real estate agent to finalize the sale and fees to be paid to the land office such as stamp duty and transfer fees. You will sign a final agreement at this stage and wait for a short evaluation period of your loan – usually a few days. When the review is finished, you’ll do a final walk-through and take possession of the property.

How Long Does a Mortgage Application Take in Thailand?

A mortgage application in Thailand takes 3-10 days from the time that you submit your documents for review.

Need help sorting out mortgages and deciding on the right property for your budget? Consult with PropertySights Real Estate’s team of experts today to find the perfect fit for you.